- #Should due to due from balance for free#

- #Should due to due from balance how to#

- #Should due to due from balance plus#

#Should due to due from balance for free#

Let IRS do your taxes?: How would you like to file your taxes for free? IRS launching pilot program for free e-filing If you discover too much is withheld, you can make the adjustment with your employer, which will result in larger paychecks during the year and a smaller refund. Conversely, if too little is withheld, you can adjust the withholding, so your tax bill is smaller at tax time though your regular paycheck may be smaller. "You may still owe next year when you file, but you won’t owe the underpayment penalty.”įor those who aren’t sure if tax withholdings from their paychecks are sufficient to cover their tax obligations, they can use the IRS’ Tax Withholding Estimator tool to check if the right amount is being withheld.

"If you're not sure what your total income is going to be for the current year, simply take your last year’s tax liability and split it into four equal parts and use those for your estimated tax payments," said Mark Steber, chief tax information officer at Jackson Hewitt Tax Services. Publication 505, Tax Withholding and Estimated Tax includes worksheets and examples that can be helpful to those with dividend or capital gains income those who owe alternative minimum tax or self-employment tax or special situations. 31, 2024, and pay the entire balance due with your return.Ĭheck your bracket: What are the IRS tax brackets? What are the new federal tax brackets for 2023? Answers hereĪvoiding taxes: How do rich people avoid taxes? Wealthy Americans skirt $160 billion a year in tax payment How do I know how much I owe?įorm 1040-ES, Estimated Tax for Individuals, includes instructions to help taxpayers figure out their estimated taxes. 16, 2024, if you file your 2023 tax return by Jan. You don’t have to make the payment due Jan. You could’ve paid the full-year estimate when you filed your taxes on April 18, otherwise, they are due quarterly. Income thresholds: Minimum income to file taxes in 2023: Not everyone needs to file When are estimated taxes due? Senior tax: Social Security benefits are rising, but so are the taxes. They should consult IRS Publication 505, Tax Withholding and Estimated Tax.

◾ You expect your withholding and refundable credits to be less than the smaller of: 90% of the tax to be shown on your current year’s tax return or 100% of the tax shown on your prior year’s tax return. (Your prior year's tax return must cover all 12 months.)

◾ You expect to owe at least $1,000 in tax for the current year after subtracting your withholding and refundable credits.

#Should due to due from balance plus#

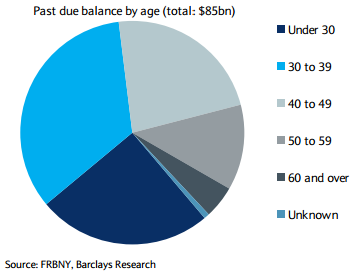

Estimated tax is used to pay income tax plus self-employment tax and alternative minimum tax.Įven if you have taxes withheld from your paycheck, taxes also must be paid on income that’s generally not subject to withholding such as interest, dividends, capital gains, alimony and rental income.Ī rule of thumb to know if you must file quarterly individual estimated tax payments is if the following apply, according to the IRS: Who pays? Usually, it's self-employed individuals, gig workers, retirees, investors, businesses, corporations and others who don’t have taxes withheld or it's employees who don't have enough taxes withheld by their employers throughout the year who will pay quarterly estimated taxes. Do you live in one of them? Who must pay quarterly estimated taxes? State tax: These states want a cut of your Social Security check.

#Should due to due from balance how to#

If you don’t make timely payments, you'll be penalized and end up paying more.īut how do you know how much you need to pay and if you even must pay? This guide will break it down for you and give you tips to make sure you’re following the law:Ĭorrect estimates count: Tax Q&A: How to avoid penalties on estimated taxes The third and fourth payments are due in September and January 2024. 1 through March 31 was conveniently due on the tax deadline, April 18, and the second one covering April 1 through May 31 is due June 15.

There are two ways to pay tax: withholding taxes from your pay, your pension, or certain government payments, such as Social Security, or making quarterly estimated tax payments during the year. June 15 is next week, which means if you don’t have taxes taken out regularly from your paycheck, you need to write Uncle Sam a check soon.Īmerica’s taxes are pay-as-you-go, so you must pay most of your tax during the year as you receive income, rather than paying at the end of the year.

0 kommentar(er)

0 kommentar(er)